In today’s time, if you live in America and want to take a loan, credit card, or mortgage, theyour n Credit score is the biggest factor for you. Many people understand its importance late and later get into trouble. In this article, we will understand what Credit Scores are, why they are important, and what easy ways are to improve them.

What are credit scores, and why are they important

In simple terms, a credit score is a three-digit number (usually between 300 and 850) that tells how timely you have paid your debts or bills. Meaning, what is your record of managing and returning money? In the US, this score is decided by three major agencies – Experian, Equifax, and TransUnion. The higher this number, the easier it is for you to get a loan or credit card.

The higher your credit score, the more likely you are to get a loan or credit card at a lower interest rate. Not only this, but credit scores are also checked many times during background checks for renting a house or for a new job.

US Credit Score – Key Points

- Credit scores are often 3-digit numbers like these (300–850).

- Experian, Equifax, TransUnion determine these scores.

- The higher your score, the lower the interest rate at which you will get loans/credit cards.

- The score is also considered in background checks for renting a house or for a job.

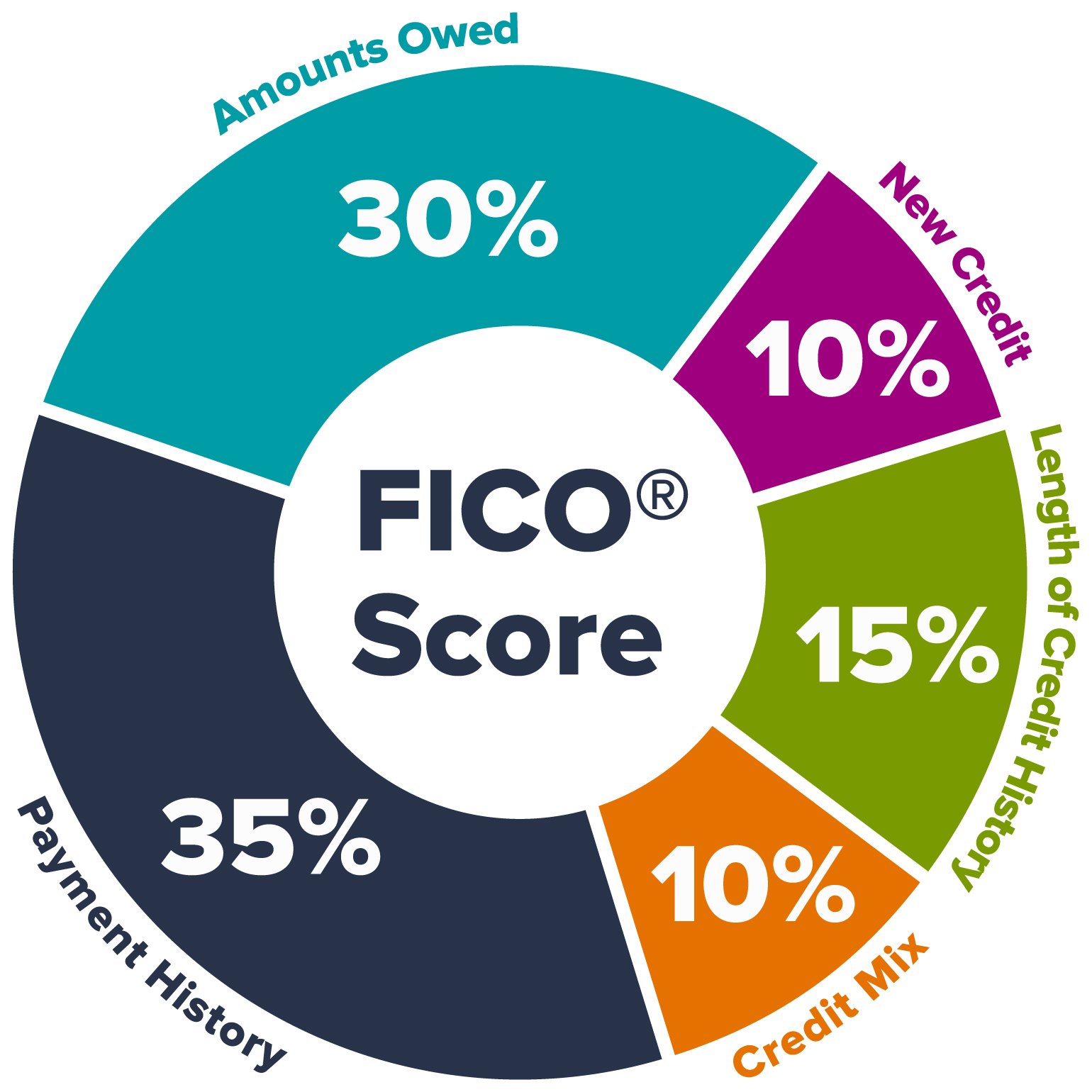

The main factors that affect your credit score

- Payment history: Paying bills and loans on time is of utmost importance. Even a single late payment can bring down your score.

- Credit utilization percentage: Try not to use more than 30% of your credit card limit. The less you use, the better.

- Age of credit history: Do not close old accounts. The older the accounts, the stronger your credit history will be.

- Credit mix: Maintaining a balance of different types of credit, such as car loans, credit cards, and personal loans, is also good for the score.

- New credit inquiries: Frequently applying for a new credit card or loan can hurt your score.

Key Factors of Credit Score

- ✅ Pay bills and loans on time – late payments lower your score.

- ✅ Use less than 30% of your credit card limit.

- ✅ Don’t close old accounts – the history will become long.

- ✅ Keep different types of credit (car loans, cards, personal loans) balanced.

- ✅ Do not apply for a new credit card/loan repeatedly.

How to Check Credit Scores?

In the US, you are entitled to one free credit report every year. You can easily view reports from Experian, Equifax, and TransUnion by visiting AnnualCreditReport.com. This will allow you to check your credit record, and if there is any mistake or fraud, you can catch it and correct it in time.

Easy and legal ways to improve credit scores

- Pay bills on time: This is the first and foremost step. The more often you make payments on time, the better your credit score will be.

- Keep credit card balances low: Excessive use of card limits pulls down the score. Try to keep balances low.

- Don’t close old accounts: Keep old accounts open; this helps to make your credit history longer and stronger, and also keeps your score good.

- Correct errors: If you see any discrepancy in your report, file an objection to get it corrected immediately.

- Do not take too much credit at once: Frequently taking new cards or loans increases inquiries and can bring down your score.

Habits for Long-Term Healthy Credit Scores

- Make a budget every month and spend accordingly.

- Keep an emergency fund so that there are no late payments.

- Use credit wisely and take loans only when needed.

Conclusion:

If we talk about America, a big part of life related to money depends on a credit score. Understanding and improving it is not an instant task, but a gradual process. If you pay bills on time, keep the card balance low, and maintain a good credit history, then your score automatically improves with time.

By adopting the right information and good habits, you can strengthen your credit score and also secure your future related to money.

FAQs

Q1. How many points is a good credit score?

In the US, a credit score above 670 is generally considered good. Above 740 is called very good, and above 800 is called excellent.

Q2. How to increase credit score quickly?

Paying bills on time, keeping credit card balances low, not closing old accounts, and correcting errors in your report – all these help in improving your credit score quickly.

Q3. Does checking your credit score lower your credit score?

No, when you check your credit score yourself, it is called a “Soft Inquiry,” and it does not reduce your credit score. Only a “Hard Inquiry” (when applying for a new loan or credit card) can slightly affect the score.

Also read:

Top 10 Ways to Save Money on Everyday Expenses in the US

How to Budget Effectively in the US: Tips for Every Income Level

Fractional Real Estate Investing in the U.S.: Platforms for Beginners