If you’re looking for promising stocks under $10, this list highlights 8 affordable picks that could deliver strong returns.

Many people look for stocks that are priced below $10 because the opportunity is great. With less money, you can bet on companies that are currently cheap or that are just starting to grow. Yes, it is also true that not every cheap stock turns out to be good—some are really cheap for a reason. But if the right ones are chosen with a little thought, then such cheap shares can also give good profits. That is why in this article, we will show you 8 such stocks that are currently available below $10 and about which experts say that they have full potential to grow.

(Note: This article is for educational purposes only, not financial advice.)

Why Stocks Under $10 Attract Investors

- Affordable entry point: Even small investors can buy more shares without investing much money.

- High-yield opportunity: Stocks of new or fast-growing companies often start at low prices, and profits can be big if the company grows.

- Historical examples: In the past, shares of big companies like AMD and Ford were available for a few rupees (single digits). But later these shares showed tremendous growth and gave huge profits.

Key Factors Before Buying Cheap Stocks

Brother, before investing in any cheap stock that is available below $10, you must consider the following points:

- Strong foundation: The company’s earnings should be growing, there should be a proper flow of money, and there should not be much debt.

- Industry situation: Look at the sector in which the company is – technology, green energy, healthcare, or fintech – all these have scope for growth.

- Analysts’ opinion: If most experts say buy or hold, then the confidence increases a little.

- Risk: Keep in mind, cheap shares have more volatility; sometimes there may be problems in selling, and sometimes the company itself may become weak.

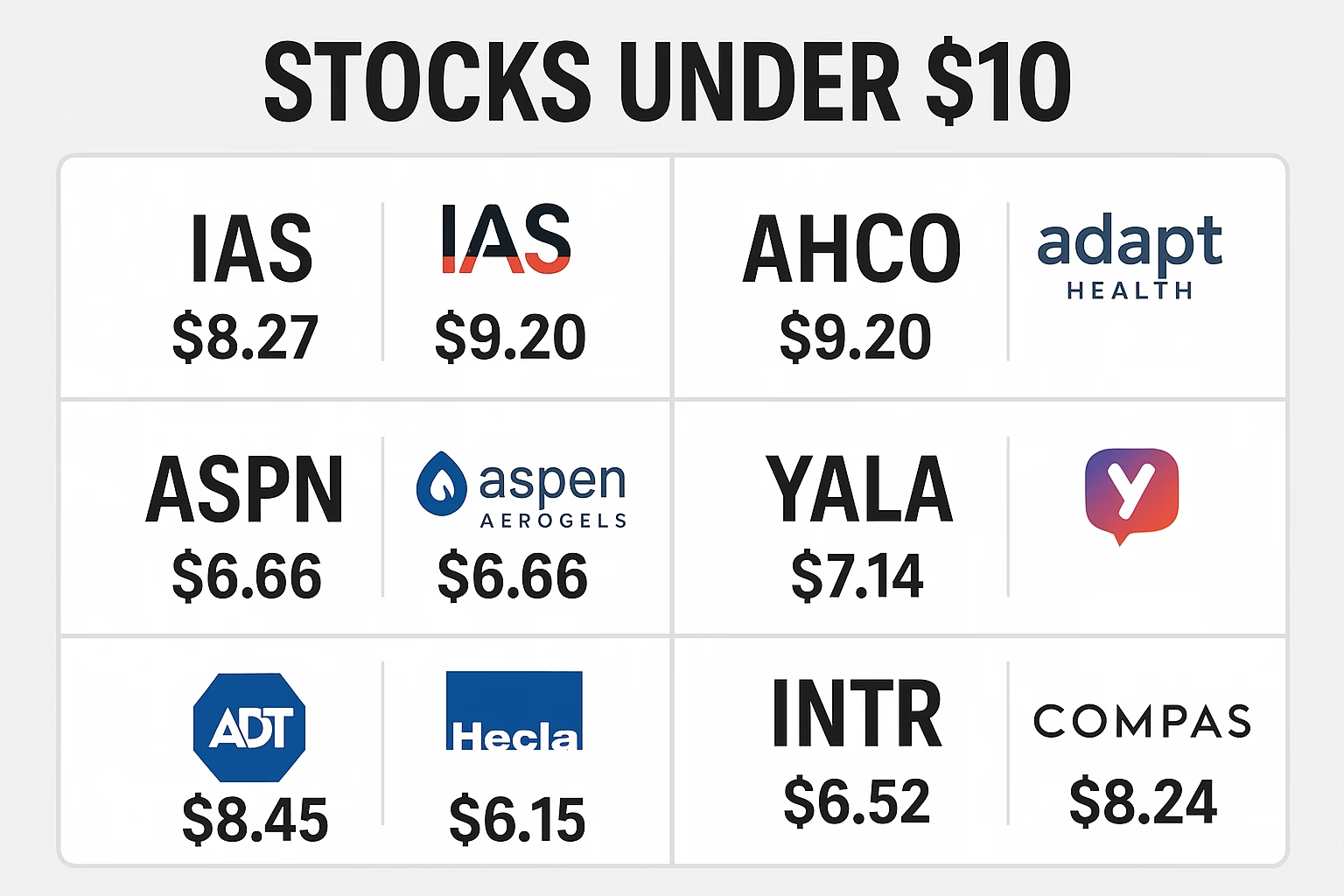

8 Stocks Under $10 With Growth Potential

1. Integral Ad Science (IAS)

- Price: ~$8.27

- Why it matters: The company is a leader in digital ad verification. Experts believe it has a lot of potential, and most have called it a ‘strong buy’. It is estimated that it can rise by about 55%.

- Risks: The field of ad-tech is quite tough, as there is a lot of competition. On top of that, the company’s earnings can be quickly affected by major economic changes.

2. AdaptHealth (AHCO)

- Price: ~$9.20

- Why it is important: This company provides medical equipment and services at home. As the number of elderly people is increasing, their demand will also increase. Analysts believe that it can grow by about 54%.

- Risk: If the government changes the rules for healthcare reimbursement, the company’s profitability could come under pressure.

3. Aspen Aerogels (ASPN)

- Price: ~$6.66

- Why it matters: The company specializes in aerogel technology, which is used in electric vehicles and clean energy. Experts believe that it has a growth potential of about 43%.

- Risk: The demand for this company is mostly related to new and emerging sectors. Such sectors sometimes grow rapidly and sometimes can fall suddenly, so the risk is a little higher.

4. Yalla Group (YALA)

- Price: ~$7.14

- Why it matters: This company runs a voice-based social networking platform in the Middle East. Looking at the increasing interest of people and user growth, experts believe that it can grow by about 54%.

- Risk: The biggest problem for this company is that everything depends on the activity of the users. If people do not use it much, then the growth can stop. On top of this, different rules and regulations in areas like the Middle East can also pose challenges for the company

5. ADT (ADT)

- Price: ~$8.45

- Why it is important: This company is known for home security, and its business model runs on subscription. That is, there is a fixed revenue every month, due to which its earnings remain strong and consistent.

- Risks: The company has a high debt burden and is facing tough competition in the market from affordable and easy DIY (do-it-yourself) solutions such as Ring and SimpliSafe.

6. Hecla Mining (HL)

- Price: ~$6.15

- Why it is important: This company is a big player in silver and gold mining. If the prices of gold and silver keep rising, it will directly benefit from it and its earnings can grow rapidly. Experts believe that there is scope for growth of up to 24%.

- Risk: The prices of things like gold and silver do not always remain the same. Sometimes they increase a lot and sometimes they can fall suddenly. This fluctuation is the biggest risk for this company.

7. Inter & Co. (INTR)

- Price: ~$6.52

- Why it’s known: This Brazilian digital bank is growing rapidly and is performing well on both profit and revenue. If you are thinking of investing in the fintech sector, then this company could be an interesting option for you.

- Risk: Operating in emerging countries can make the company vulnerable to foreign currency and political fluctuations.

8. Compass (COMP)

- Price: ~$8.24

- Why it matters: This is a tech-driven real estate platform that has delivered stellar returns in just one year, even outperforming the S&P 500. Analysts also consider it a buy and give a price target of around $11.

- Risk: The company’s business is linked to the housing market, so if interest rates rise or the real estate market slows down, it can directly impact the company.

Risks of Investing in Stocks Under $10

- Volatility: Cheap stocks often experience sharp fluctuations in short periods of time, which can make investors nervous.

- Liquidity problem: Sometimes there are fewer buyers and sellers in such stocks, which can make it difficult to sell at the right time.

- Effect of speculation: Crowds of retail investors or social media hype can push their prices up for a short time, but this is not always sustainable.

- Risk of dilution: Companies may issue new shares to raise cash, which can reduce the value of existing shares.

Smart Tips for Investors

- Diversification is important: Never put all your money in a single stock. Investing in different companies and sectors reduces risk.

- Use stop-loss: If the market suddenly falls, stop-loss can limit your losses.

- Invest in the right place: Always avoid OTC penny stocks and invest in companies listed on a trusted exchange (NASDAQ/NYSE).

- Stay updated: Keep an eye on company earnings reports, major sector news and analysts’ opinions. This helps in making better decisions.

Conclusion:

Although stocks priced under $10 always come with a small amount of risk, proper research and smart stock picking have the potential to generate substantial profits. The eight companies mentioned above—whether it’s ed-tech, healthcare, mining, fintech, or real estate—all offer strong opportunities in their respective sectors. If you’re patient, focus on risk management and do your homework before investing, these cheap stocks can be a great addition to your portfolio.

Disclaimer

This article is for educational purposes only and should not be taken as financial advice. Always conduct your own research or consult a licensed financial advisor before investing in any stock.