Many types of reports are released to understand the US economy and the world of investment. One of the most important of them is the PPI report. This report tells in which direction the inflation is going and the health of the economy. If you invest, have a 401(k) plan, or are interested in the stock market, then it is very important for you to understand the PPI report.

What is a PPI Report?

PPI-Report means Producer Price Index Report. This report is released every month by the US Bureau of Labor Statistics (BLS). It measures the rate at which the prices of goods and services sold by domestic producers are increasing or decreasing. It gives an early indication of inflation because when the cost of production increases, its effect eventually reaches the consumers as well.

This report is important for people investing in the US because it tells what impact it can have on the Consumer Price Index (CPI) and interest rates in the future. PPI Report is also often called an “advanced indicator of inflation”.

Why the PPI Report is important for investors

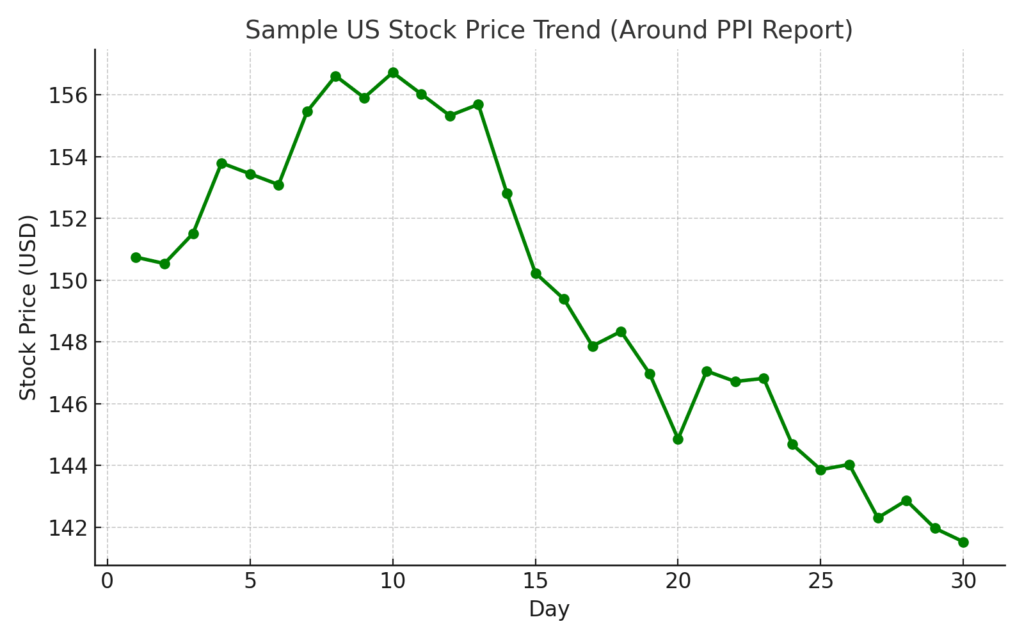

In the US, both the stock market and the bond market react immediately to economic data. When the PPI report shows higher inflation than expected, the possibility of the Federal Reserve raising interest rates increases. On the contrary, if the report shows lower inflation than expected, the market may experience relief and boom.

For example, if the PPI report shows that the cost of production is increasing rapidly, it means that the profits of companies may come under pressure. This is an indication for investors about which sectors they should focus on in their portfolio.

Impact on the US economy and consumers

The PPI report is important not just for investors but also for American families. When producer prices continue to rise, it is reflected in the prices of everyday items. It can also affect mortgage rates, credit card interest rates, and savings account yields.

For ordinary US consumers, this report indicates the direction inflation may take in the coming months. It helps in making household budgets and planning expenses.

PPI Report and the Federal Reserve

The Federal Reserve (Fed) is the central bank of the US, which decides on interest rates and monetary policies. The PPI Report helps the Fed assess how much price pressure is increasing. When the PPI Report shows consistently high figures, it becomes difficult for the Fed to lower interest rates.

Similarly, if the report shows low price pressure, the Fed may consider cutting rates. This directly affects the strength of stocks, bonds, and the dollar.

Useful Tips for Investors

- Track the data: Keep an eye on the monthly PPI report and read it carefully.

- Compare with other reports: Combine it with CPI and employment data to get the full picture.

- Diversify your portfolio: Certain sectors, such as commodities and energy, may perform better in the case of rising inflation.

- Think long-term: Avoid making major decisions based on just one month’s report.

Conclusion:

In short, the PPI Report gives an important glimpse of the health of the US economy and inflation trends. This report provides valuable information for investors, economists, and ordinary consumers. Understanding it can not only help you better understand the fluctuations in the stock market and interest rates but also make your financial decisions stronger.

The next time the PPI Report is released, don’t ignore it as just economic data. It carries important clues for both your investment portfolio and personal finances.

Related Articles:

Gold Price Hits Record High – Is it right to buy now?

Hour Loop Stock Soars 93% in a Day – Is This the Next Meme Rally?