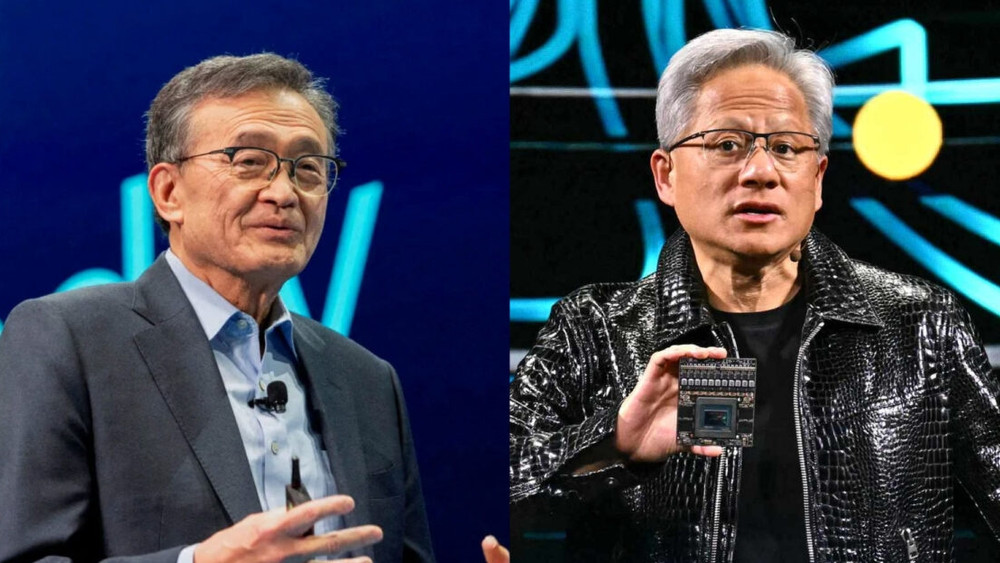

Today’s biggest news: Nvidia has announced an investment of approximately $5 billion in Intel’s stock. This isn’t just a financial investment – it’s a smart partnership in which the two companies will jointly develop new products and technologies for AI, PCs, and data centers. Furthermore, news of this investment has sent Intel stock soaring. But what does this decision mean, and how will it impact Intel’s stock price, rival AMD’s shares, and Intel’s future? Let’s take a closer look.

Nvidia & Intel Big News

- Nvidia invests ~$5B in Intel: Not just money, but a strategic partnership.

- Collaboration: Both companies will develop new AI, PC, and data center products.

- Impact on Intel stock: Investment news has pushed Intel shares higher.

- Market effect: Could affect rival AMD’s stock and Intel’s future growth.

What is the Nvidia-Intel partnership?

- Nvidia is now going to buy Intel shares; each share is worth about $23.28.

- Following this investment, Intel and Nvidia will jointly develop new chips and computing products for PCs and data centers. Intel will create CPUs that power Nvidia’s AI platforms, and Nvidia’s GPUs will also be integrated into PC processors.

- But this deal is still subject to government approval.

Nvidia & Intel Partnership Update

- Nvidia buys Intel shares: Each share around $23.28.

- Collaboration: Intel & Nvidia will develop new chips and computing products for PCs and data centers.

- CPU & GPU integration: Intel CPUs will power Nvidia’s AI platforms, and Nvidia GPUs will integrate into PC processors.

- Regulatory approval: The deal is still subject to government/governing body approval.

Impact on Intel Stock

- If we talk about it, as soon as the news came, Intel’s stock moved by about 30% in the pre-market.

- This investment has boosted confidence in Intel Stock as a major AI player, like Nvidia, wants to partner with Intel’s technology and CPU-GPU interface.

- This surge in Intel’s stock is significant because this investment raises hopes that the company’s difficult financial situation will improve. Intel has been facing financial difficulties and stiff competition for some time.

Intel Stock Soars After Nvidia Investment

- Pre-market surge: Intel’s stock jumped about 30% as soon as the news broke.

- Confidence boost: Big AI player Nvidia partnering with Intel strengthens trust in Intel Stock.

- Significance: Investment raises hopes that Intel’s challenging financial situation may improve.

- Background: Intel has been facing financial difficulties and tough competition for some time.

How about competitors AMD and others?

- This news is a concern for AMD stock and companies like it, as the Nvidia-Intel partnership could impact their AI and data center business partnerships.

- AMD, which competes with Intel’s CPUs and GPUs, may be forced to innovate and increase pricing in its products in the face of this new pairing.

- Experts believe this could impact AMD’s news and share price, especially if the Nvidia-Intel partnership leads to a quicker launch of new products.

Intel’s challenges and risks

- Intel continues to struggle with its foundry business. The Nvidia-Intel partnership doesn’t currently involve significant factory work.

- Regulatory hurdles may arise, as antitrust and other legal processes can hinder such large investments.

- Nvidia and Intel’s technologies and working methods differ, so proper coordination will be crucial for this partnership to succeed.

- If AI and data center demand don’t grow as expected, this investment may not yield the desired benefits.

What could happen next?

- Intel and Nvidia could jointly introduce new AI server chips and data center products, which could improve Intel’s stock and the long-term value of INTC.

- Intel, which has been undergoing a new CEO and transition process for some time, could enhance its research and manufacturing capabilities through this partnership.

- The US government recently acquired a nearly 10% stake in Intel to provide stability to the company. This partnership and government support could strengthen Intel’s position.

- Companies like AMD and TSMC (if they join) will now focus on greater innovation and lower prices in the market. This will increase competition, but Intel also has opportunities if it introduces new products promptly.

Intel & Nvidia Partnership: Market Outlook

- New AI & Data Center Products: Intel and Nvidia could launch AI server chips and data center products, boosting Intel stock and long-term INTC value.

- R&D & Manufacturing Boost: Intel, amid CEO transition, could strengthen research and manufacturing through this partnership.

- Government Support: US government owns nearly 10% of Intel, adding stability; partnership + support could strengthen Intel’s position.

- Market Competition: AMD, TSMC (if involved) may focus on innovation and lower prices, increasing competition—but Intel has opportunities if new products launch on time.

Conclusion:

Now, the news that Nvidia invested $5 billion in Intel isn’t just an investment; it could be a major shift in the tech industry. This is a positive sign for Intel’s stock, as this investment, partnership, and government support could help the company make a comeback. Competition will intensify for companies like AMD, but it’s time for Intel to consider how to capitalize on this opportunity.

If you’re an Intel Stock investor, you should keep an eye on Intel stock progress going forward, based on quarterly earnings, new product launches, and demand from the AI market. Regularly checking Intel Stock news will be helpful.

See also:

🔷 Housing Market 2025: Will Buyers Benefit From US Rate Cut or Not?

🔷 US Interest Rate Cut: Will this give new impetus to the Housing Market?

🔷 Disney Stock Alert: Sapient Capital LLC Buys 182,082 Shares – Bullish Signal?