Ford is considered an old and trusted name in the automobile industry. Not only in America but all over the world, the vehicles of this brand are a part of the daily life of millions of people. But recently some big news has caught the attention of both investors and customers. The company has announced the recall of about 1.5 million vehicles. The reason is the defect in the rear-view camera, which is very important for the safety of the driver.

Ford Recall: 1.5M Vehicles Pulled, Stock Faces Pressure

Ford is considered an old and trusted name in the automobile industry. Not only in America but all over the world, the vehicles of this brand are a part of the daily life of millions of people. But recently some big news has caught the attention of both investors and customers. The company has announced the recall of about 1.5 million vehicles. The reason is the defect in the rear-view camera, which is very important for the safety of the driver.

What is the matter?

This recall is for vehicles sold in the US that have been found to have problems with their rear-view cameras. In some cases, the camera was showing blurry, upside-down, or completely black images on the screen. This impedes rear visibility and can increase the risk of accidents. According to reports, so fa,r Ford has received thousands of warranty claims related to this problem, and 18 accidents have also been reported. However, the relief is that no serious injuries have been confirmed.

Impact on investors

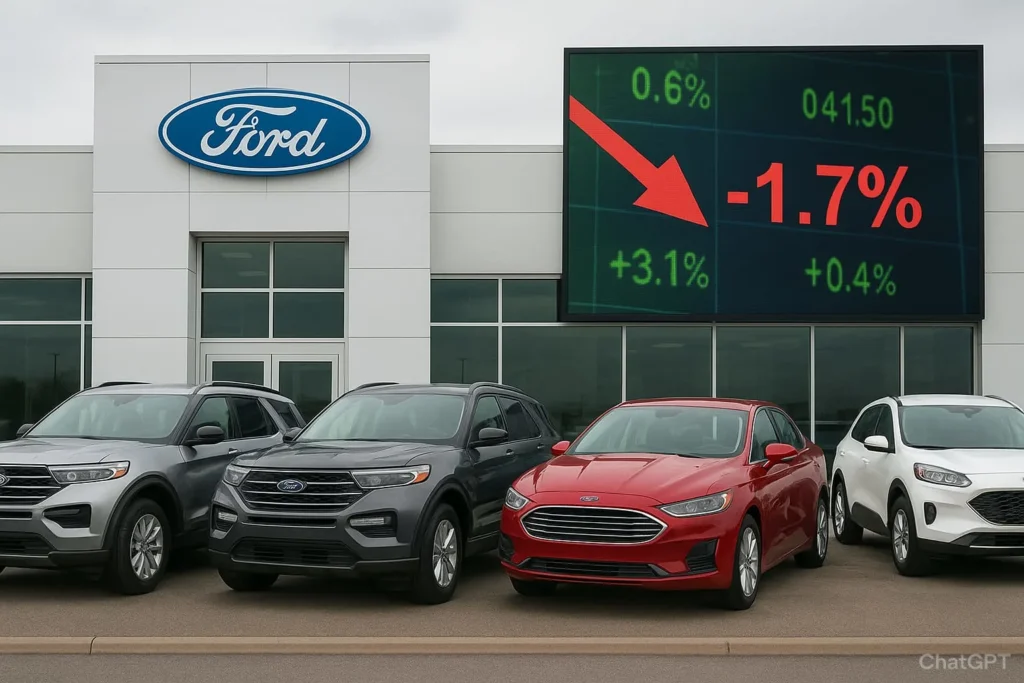

Whenever a big auto company has to recall millions of vehicles, it directly affects its trust in the market and its stock price. The same happened with Ford. The day the recall was announced, the company’s stock fell by about 1.7% to close at $11.49. Interestingly, the broader market was in the green at that ti;e, that is, the rest of the stocks were performing well, but Ford’s stock came under pressure.

It is clear from this that investors have become cautious at the moment. Recalling vehicles increases the cost of the company and also affects the brand image. However, it is important to note that Ford’s stock is up about 18% since the beginning of the year. That is, the long-term trend is still positive, but such developments definitely create concern among investors.

What matters to customers?

For American families who drive Ford cars, this news has a mixed effect. On one hand, it raises concerns that the car lacked safety, while on the other hand, it also gives confidence that the company took immediate action as soon as the problem was discovered and decided to recall the vehicles.

Rear-view camera is not just a convenience in today’s cars but a guarantee of safety. This feature is considered essential for parking, child safety, and seeing pedestrians walking behind. Therefore, this recall can be seen not just as a technical flaw but also as a major safety step.

The road ahead for Ford

The question is, will this recall harm the company’s long-term image? The answer is not easy. Recalls are common in the automobile industry—companies like Tesla, General Motors, and Toyota have also recalled millions of vehicles. The only difference is how quickly and with how much transparency each company resolves the problem.

Ford has taken very proactive steps in this matter. The company gave timely information to the customers, clarified the problem, and also provided a solution. This transparency will help a lot in maintaining the trust of the customers in the future.

Lessons for investors

If you invest in the US stock market and keep track of auto stocks like Ford, this event teaches you a few important things:

- The impact of recalls is short-lived. It has often been seen that when companies take quick corrective action, the stock gradually recovers.

- Long-term vision is important. Despite Ford’s current challenges, the company is investing heavily in electric vehicles and technological innovation.

- Keep diversification. If your investment is limited to the auto sector, then such a shock can impact your portfolio. Therefore, always keep sector and asset diversification.

Conclusion:

Simply put, this recall by Ford is putting pressure on its image and share price in the short term. But the good thing is that the company is clearly putting customer safety first. The lesson for investors is that such ups and downs keep happening in the automobile industry, and even the biggest companies have to face such challenges sometimes.

If you are investing for the long term, then instead of panicking, it is better to focus on the bigger picture. The Ford brand is still strong; it has a strong hold in the American market, and the company also has clear plans for the future. In such a situation, it can be believed that Ford has both the experience and strength to overcome the challenges.

Related Articles:

Forget Tesla’s Cybertruck – Why People in the US Can’t Stop Talking About the Hummer EV

From Gas Guzzler to EV Beast: How the Hummer EV Is Stealing Tesla’s Spotlight

Move Over Tesla: Hummer EV Is the New King of America’s SUV Game