Jio BlackRock’s MD and CEO, Sid Swaminathan, who has already overseen more than $1.2 trillion across 500 listed portfolios at BlackRock, pushed that following an initial file, “is difficult work” and requires limiting both exchange costs and market impact, particularly during rebalancing.

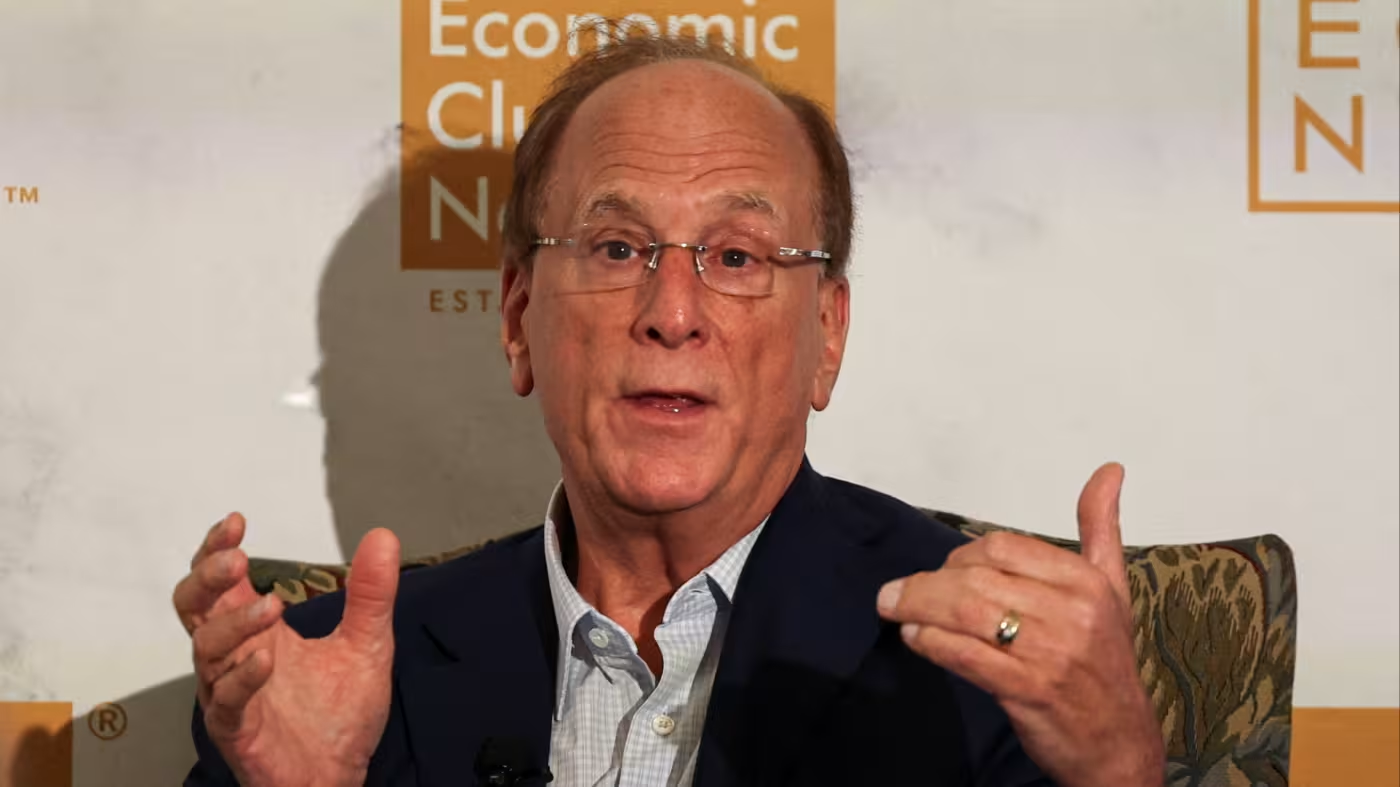

The BlackRock CEO, Larry Fink, is set to rule in 2025. As head of the world’s largest resource manager—with over $11 trillion in AUM—his experiences with advertising dangers and cryptocurrency carry considerable weight. In this article, we investigate the BlackRock CEO’s net worth, his changing position on BlackRock CEO bitcoin, and why BlackRock CEO Larry Fink cautions that stock markets seem to drop advance in the midst of retreat concerns and exchange instability.

1. BlackRock CEO Net Worth. 💰

The BlackRock CEO’s net worth is evaluated at around $1.5 billion as of early 2025. Fink co-founded the firm in 1988, and under his administration, BlackRock has developed from a risk-focused start-up to a worldwide powerhouse supervising more than $11 trillion in assets. His compensation reflects stock holdings and performance incentives tied to BlackRock’s continued dominance.

2. BlackRock CEO Bitcoin: From Skepticism to Bullish.

Generally cautious approximately cryptocurrency, the BlackRock CEO’s bitcoin viewpoint has moved strongly. At Davos in January 2025, Fink embraced organizational inclusion in Bitcoin:

“If everyone adopted a 2% or 5% allocation, you could see Bitcoin at $700,000”.

That vision of BTC at $700K stems from potential inflows by means of BlackRock’s iShares Bitcoin Believe. Whereas bullish, he cautions financial specialists to regard Bitcoin’s instability and administrative instabilities.

3. BlackRock CEO Larry Fink Warns Stock Markets Could Drop Further.

Maybe the most later and squeezing news: BlackRock CEO Larry Fink cautions that stock markets seem to drop advance. In April at the Financial Club of Unused York, Fink cautioned that U.S. stock markets may decay another 20%, citing more extreme taxes and tireless expansion.

Key points from his remarks:

- Recession signal: “Most CEOs I’ve conversed with would say we are likely in a subsidence right now,” he cautioned.

- Buying opportunity: Still, he views this dip as a buying opportunity – not a systemic collapse.

- Fed viewpoint: Fink expelled trusts for numerous rate cuts, citing solid inflation tied to taxes.

- Risk to U.S. leadership: He also flagged concerns about America’s global capital influence slipping.

4. Broader Market Context & Impact.

Fink’s market warnings align with other major voices:

- Tax weight from Washington has activated a ~10.5% drop in the S&P 500—the steepest two-day drop since March 2020.

- Ackman depicted the circumstance as a potential “economic atomic winter,” encouraging a 90-day delay.

- Jamie Dimon cautioned that rising tariffs could bring stagflation.

. His turbulence, BlackRock’s key diversification—across bonds, values, alternatives—may offer assistance to mitigate profit instability. Fink keeps up a long-term viewpoint.

5. Why It Matters: Influence & Strategy.

- Market move: As BlackRock CEO, Fink’s explanations influence financial specialists’ research and have a significant impact on worldwide markets.

- Crypto legitimacy: His pro-bitcoin shift lends credibility to institutional crypto adoption.

- Investor direction: His notices serve as a basic update for caution, but moreover for opportunity.

6. What Investors Should Watch.

| Key Area | What to Monitor |

|---|---|

| Bitcoin inflows | Increased institutional adoption via IBIT or similar vehicles—could validate Fink’s $700K thesis. |

| Tariff & inflation risks | Upcoming trade announcements—particularly on China—may intensify volatility. |

| Fed policy | Watch CPI/PPI and interest rate guidance for signs of rate stagnation. |

| Recession signals | Corporate earnings and CEO surveys will reveal economic stability. |

Conclusion

The BlackRock CEO remains among the most persuasive figures in the back. With an assessed $1.5 billion net worth, Larry Fink’s financial influence mirrors his showcase impact. His startling backing for Bitcoin, anticipating a future cost of $700K, marks a move in standard venture consideration. However, his caution that stock markets seem to drop advance underlines the require for a cautious route in today’s dubious climate. Whether you’re overseeing values or investigating crypto, Fink’s points of view offer a fundamental focal point on procedure.